The question is a valid one, given that investors’ concerns appear to be persisting or even growing, along with the surge in year-to-date gains among financial markets. The US equity market hit an all-time high in July of this year, with the S&P 500 index breaching the 3,000 point threshold, while the European market has also gained almost 20% since its December 2018 low. Far from reflecting a sense of euphoria, most surveys show that investors have maintained a more cautious positioning. This sentiment is ultimately consistent with economic data. The global industrial slowdown is much sharper than expected, with many countries posting industrial PMI figures indicating contracting economies, i.e. below the 50 threshold. This apparent de-connexion between “fundamentals” and market prices has created the current feeling of unease among investors.

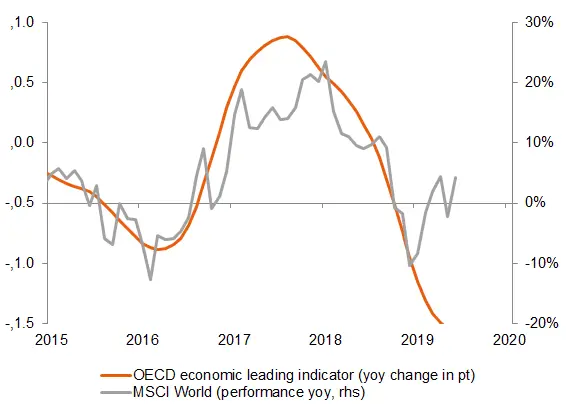

Chart 1

Sources: Bloomberg, Candriam

The global economy is not tipping into recession

The manufacturing slowdown (or even industrial recession in certain countries) probably stems chiefly from trade tensions, the Chinese economic slowdown and declining confidence across many industries. Service business is expanding and global GDP is in positive territory. Our estimated probability of a recession remains limited to a 12-month horizon. The central banks have effectively reacted very rapidly and the current easing in financial conditions should help mitigate the impact of the slowdown. Economic indicators should soon therefore adopt a more positive trend.

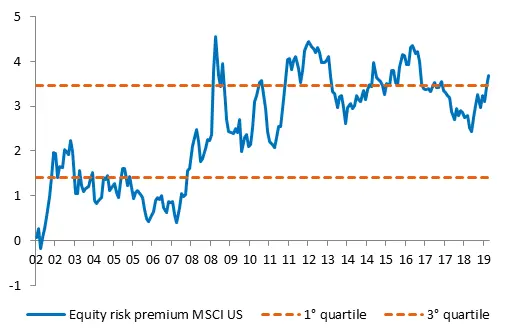

Although a recession remains unlikely over the next few months, should we be concerned over the current valuation of risky assets? Trading multiples among equities have risen since the beginning of 2019, but remain close to their long-term average. The sharp fall in sovereign yields since the beginning of the year has rendered equities increasingly attractive in relative terms. Investors seeking yield and returns are obliged to continue taking risks. This argument is currently the strongest rationale in favour of the bullish trend continuing. It nonetheless clearly represents a danger if there is no convincing improvement in economic fundamentals.

Chart 2

Sources: Bloomberg, Candriam

Sources: Bloomberg, Candriam

Banking on a repetition of the sequence of events in 2016-2017 is the main danger today, as US and European equity markets are no longer fully correlated with economic data (contrary to during the previous industrial recession in 2015-2016, as illustrated in chart 1): equities have rallied whereas economic indicators have continued to deteriorate sharply. Only the Chinese market is in sync with economic data and could benefit from a stronger rally in response to an uptick in global growth. It should also be noted that, in 2017, European economic growth came in at above 2.5% and the US was expected to benefit from tax stimulus measures which would have allowed corporate earnings to surge by more than 20% in 2018.

Where are the excesses? Where is the bubble?

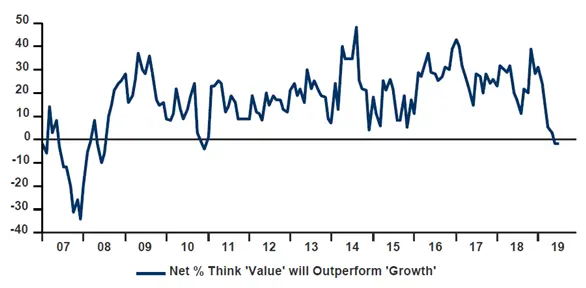

Any capitulation or justification based on the theme of a “new paradigm”, or a “new era” or “things have changed and will never be the same as before” may be considered as relatively clear signals of excess. This is the case with interest rates today. As investors, we are all convinced that we shall have to continue navigating in a low interest rate environment for the foreseeable future, with durably weak inflation and central banks remaining accommodating for the long term. The consequences of this new normality are reflected in the positive performances returned by fixed-income asset classes, as investors search desperately for yield, and also in the historically wide performance gap between growth and value stocks. Furthermore, investors have partially capitulated on this point, as the latest BofA Merrill Lynch Global fund manager survey in chart 3 illustrates.

Chart 3

Sources: Bank of America Merryll Lynch Global Fund Manager Survey

However, although global equity market valuations are not excessive, several indices are tending towards excess in terms of strong disparities between sectors and themes.

Where may the danger lie?

For the time being, 2 factors – the “Trump Put” and the “Powell Put” – are protecting the US market and consequently other financial markets to a certain extent. The danger may come from investors beginning to doubt the implicit protection provided by these factors. As the month of May illustrated, resurgent trade tensions, along with a dose of the unexpected in relations between the US and the rest of the world, can rapidly undermine the reliability of the “Trump Put” and trigger a sell-off among risky assets. Concerning the “Fed Put”, as we recently highlighted in previous comments, this new normality has been very rapidly(excessively so?) priced-in by investors, who foresee only a series of tax cuts, which we consider excessive, given the current health of the US economy.

We have therefore decided to reduce our equity exposure during July, as we believe that much of the good news is now fully priced-in and that financial markets will prove less resilient to any negative newsflow. Although certain market excesses are a source of concern in the medium term, we nonetheless believe that the search for yield in a context of sluggish growth should continue to drive investors back into equities and other risky asset classes; we shall join them once the risk-return profile becomes more compelling.