In a previous article we’ve talked about the central bank obsession with excessively low inflation and the conviction that the problem can be solved with a negative interest rate policy, the objective via this strategy being to penalise savings in order to “force” economic agents to consume and invest. The result is an absurd situation in which debt becomes an asset, borrowers are paid and lenders are the ones paying.

Absurdity exists in the financial world. But in the real world, an asset is an asset and a debt a debt. Let’s keep thinking along these lines and focus on the most important asset of European households: real estate. For real estate, the 0% threshold is much too difficult to cross: are landlords ready to pay their tenants to live on their property? Not likely! Even if “relative” reasoning works for Mr. Everyman when applied to the financial industry, the absolute truth remains that risk-taking must be rewarded by positive compensation.

If a real asset cannot have zero return, but on the liabilities side the cost of money decreases (including when it is negative), carry becomes very attractive. The logical next step is arbitrage strategies by investors, causing the return on the asset to decline and its price to climb. In actuality, as far as Europe is concerned, borrowing costs have indeed declined, but real estate prices have not really taken off. Why is that?

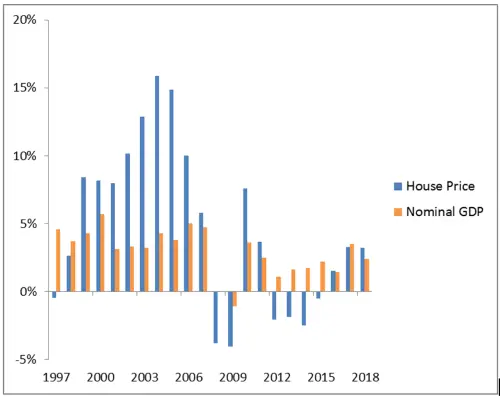

Source: Bloomberg, INSEE index

Source: Bloomberg, INSEE indexLet’s focus our analysis on France, a country we have a lot of data on and know a little something about. The chart above shows that real estate prices rose sharply in the 2000s, well above nominal GDP. Over the last ten years, however, prices have pretty much stagnated (even falling before 2015).

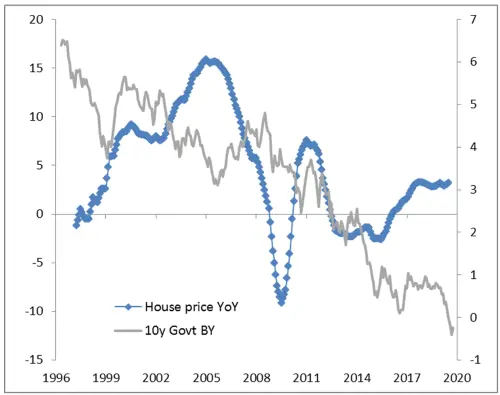

Is there a connection between interest rates and real estate prices? Apparently not, according to the following chart. Real estate prices increased more when interest rates were around 4%. Today, rates are negative and prices are growing moderately.

Trend in Residential Property Prices in Mainland France and Long-Term Interest Rates Source: Bloomberg, INSEE index

Source: Bloomberg, INSEE index

Economists will disagree with this analysis and talk about real rates or disposable income. So let’s dumb it down a little and simply ask the people around us if they base their decision to buy a house on interest rates or on events in their lives (marriage, children, new job, inheritance, etc.).

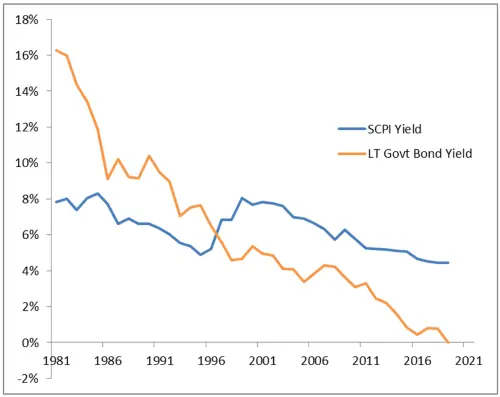

Basing the decision on interest rates doesn’t work for your average Frenchman. For an investor, however, borrowing at 1% to invest in property that can return 4% or 5% per year is a good deal. Below, we have presented the average return generated by commercial SCPIs (real estate investment companies) in France. This chart gives us two key pieces of information: first, before 1996 carry was negative and second, there does not appear to be a very strong relationship between borrowing costs (“approximated” by the French 10-year debt rate) and commercial real estate returns in France. Let’s explain these points.

Historic Return Generated by Commercial SCPIs and Interest Rates - France Source: Bloomberg, EDHEC IEIF index

Source: Bloomberg, EDHEC IEIF index

Why invest in a product with a 7% return when government bonds yield 9% (as was the case in the late 1980s)? Aside from the relative confidentiality for SCPI investors at the time, those who were buying back then were also exposed to the real estate market. And commercial real estate was flourishing. The sharp rise in prices in the second half of the 1980s made the product a little more popular, but at the same time mechanically brought down returns.

The real estate crisis of 1990/1991 put an end to the fad, and the shine did not return to the SCPI investment apple until the early 2010s. The negative carry seen in the 1990s served as a premium on exposure to the major revaluation of the real estate market.

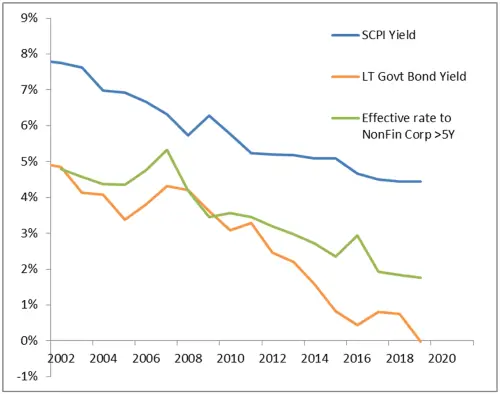

Looking at the relationship with interest rates, if we take effective interest rates from non-financial companies, we get the impression – at least visually – of a certain consistency (although we don’t have the pre-2002 series to verify this idea).

Historic Return Generated by Commercial SCPIs and Interest Rates - France Source: Bloomberg, EDHEC IEIF index

Source: Bloomberg, EDHEC IEIF index

Today, it would appear that investors searching for yield are motivated by government bond rates, which are very/too low. Signs of the search for yield are everywhere. French institutional investors are no exception: according to the Fédération française de l’assurance (FFA - French Insurance Federation), real estate went from making up 4% of insurance company portfolios in 2014 to 6.1% in 2018(1). Bearing in mind that sovereign bonds represent 31% and corporate bonds 37%, there is no reason to think that the percentage of real estate investments in the allocation will collapse should central bank monetary repression continue.

The real estate boom in the second half of the 1980s initially involved commercial property in the Greater Paris area before spreading to residential property - first in the Greater Paris area then going nationwide (although to a lesser extent). This time around, we can visualise a boom driven by demand from investors searching for (positive) yield. With rent on something of a rigid decline, investor demand should trigger a price rise. This is actually something we’re already seeing, but the trend may well intensify. This scenario is becoming increasingly likely.

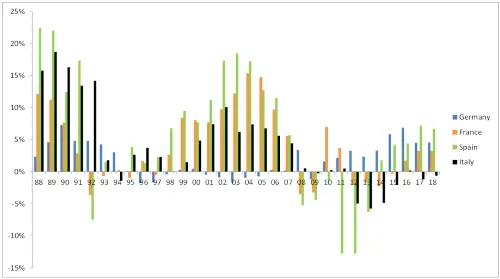

Annual Trend in Property Prices - BIS Indices

Source: Bloomberg

Source: Bloomberg

The chart above presents the annual change in real estate prices measured by the Bank for International Settlements (BIS). It reminds us that price momentum has always been very different for the four major countries of the euro zone. Accordingly, our France-centric analysis cannot be extrapolated to the rest of Europe. However, Germany looks to be in a fairly similar situation as France. The Eurostoxx Real Estate Index, predominantly consisting of French and German real estate investment companies (96%), is the top-performing sector(2) of the second half thus far. Is there a message there? This could be the start of a more pronounced trend.

(1) See https://www.ffa-assurance.fr/etudes-et-chiffres-cles/assurance-francaise-donnees-cles-2018

(2) Past performances are not a reliable indicator of future performances.