Nicolas Forest, Global Head of Fixed Income, breaks down inflation scenarios and offers strategies to reduce sensitivity

Nicolas, can you set the stage for us?

Over the past year, we have seen a marked upturn in inflation. US inflation 'prints' reached their highest level since the early 1990s, with the US all-items Consumer Price Index reaching 5.4 % at the end of June! This spike results principally from the global economic reopening after the Covid-19 shock. Inflation is gradually moving higher in the Euro zone as well.

A combination of factors including rising commodity prices, supply chain disruptions and supply/demand imbalances are contributing to the rise in prices. These could prove ‘transitory’. The spike in shipping costs arising from health restrictions in some ports, the chip shortage resulting from explosive demand from the technology sector, and lumber prices that are affecting construction sector offer some examples of the current rise in prices.

But the more Covid variants take hold, the more bottlenecks persist and the greater the pressure on prices. As the pandemic varies across regions, so does the economic recovery. So the temporary uptick in inflation could take longer to normalize than initially expected. It will take time to resolve temporary disruptions. Our Candriam economists expect US inflation around 3.6 % at the end of this year and chip supply disruptions through the first quarter of next year, before returning to 2.3% for 2022. For the Euro zone we forecast a temporary spike in monthly inflation data above 2% in the second half, before decelerating towards 1.6% in 2022.

Price stability is the first mandate of Central Banks. How will they react? Are they behind the curve ?

On both sides of the Atlantic, the strength of the post-pandemic economic recovery will pave the way for policy normalization following the ultra-accommodative steps taken since the start of the pandemic in early 2020. But reducing support will be very gradual, as central banks describe the inflation push as ‘transitory’. Moreover new monetary policy frameworks reveal disparities between Central Bank guidance on each side of the Atlantic! It is useful to consider the ECB and the Federal Reserve separately.

Following the strategic review released last year, the US Federal Reserve now has dual objectives, including price stability and a mandate for more inclusive employment. The Fed adopted a flexible 2% average inflation target, or FAIT, to be measured over time depending on the labour market. The Fed can therefore accept an overshoot in inflation if labour market conditions remain sufficiently far from maximum employment. During the last FOMC meeting in June, policy makers revised their economic projections upwards -- including inflation. These forecasts incorporated the expectation that emergency support measures may soon no longer be necessary given vaccination progress and economic recovery. Furthermore the Fed signalled two rate hikes by end 2023 through their 'dot plot' change, indicating that the central bank is not behind the curve!

Moving to the EU, it seems clear to us that the ECB wants to maintain an accommodative bias for much longer than most of their Developed Market Central Bank peers. The ECB's medium-term inflation forecasts are not aligned with their inflation target, challenging their ability to achieve it. Recently, the ECB unanimously approved a new monetary policy strategy, setting an unambiguous 2% symmetric inflation target. More housing-related costs will also be included in the definition of HICP inflation. While those changes will not directly drive inflation up, we think they should provide the ECB with a framework allowing the Governing Council to pursue monetary accommodation for a longer period. The new monetary framework, combined with a more favourable macro-economic environment and the sizable fiscal boost, should help to bring inflation closer to the target.

What does this mean for inflation expectations in the markets?

Looking to inflation expectations discounted by the markets, we believe those are too low.

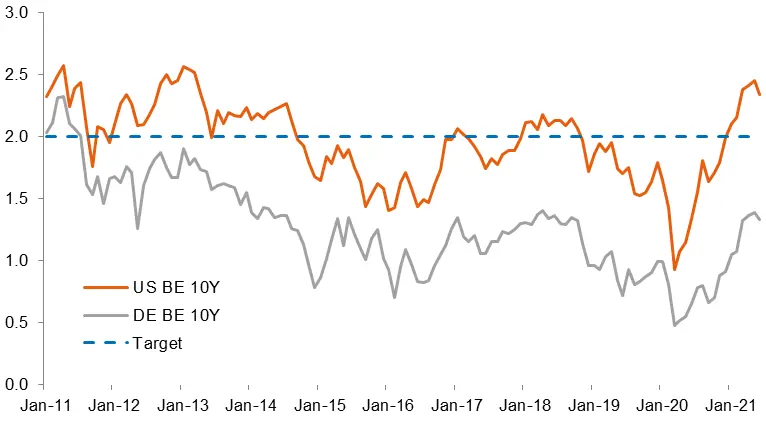

While we have already seen a noteworthy rise since the massive downturn in early 2020, we think global inflation-linked bonds still offer opportunities. Our calculations show Euro linkers, for example, are pricing in persistent policy undershoots, even when adjusted for seasonality. While a significant portion of the inflation upturn expected in the second half should prove transitory in the Euro zone, current inflation expectations below 1.5%, after adjustment for seasonal effects, leaves a margin for potential performance. Meanwhile, looking from an historical perspective, inflation expectations are still far away from the peaks above 2% priced into the 10-year maturities in 2011 (see Figure).

Furthermore, in the US, after the weakness in inflation break-evens seen in June, inflation breakeven expectations priced in to the bonds are not excessive. We think bonds should begin to price in higher inflation risk premiums when one considers the upside inflation surprises seen in the US in recent months, along with the Fed's apparent lack of urgency in reducing its accommodative stance.

Figure 1: Inflation Break-Evens, US and European Bond Markets

Which investment strategies might be appropriate for investors who are sensitive to inflation ?

In the context of a low-rate environment and the expected normalization of global supply issues, we expect dispersion between regions, sectors and issuers to rise.

With this in mind, it is important to favour diversification in investments, and to hold global products with broad investment universes which provide a wide range of performance drivers. Within these performance drivers, selectivity is vital. With a lack of synchronization among fiscal policies and monetary approaches by region and country, we expect noticeable variations in growth and inflation outlooks across regions and an increased dispersion across markets. Adding to this are megatrends such as deglobalisation, decarbonisation and digitalization that will challenge or disrupt national and business models and increase the differences between “winners” and “laggards” in each universe.

In the Fixed Income asset class, I would suggest three approaches to inflation which can provide good risk diversification: Short-Duration Inflation-linked Bonds, defensively-managed Convertible Bonds, and Absolute Return credit.

- For investors who fear inflation or rising inflation expectations, an allocation to Short-Duration (or short term) Inflation-Linked Bonds can be a sensible option. Among inflation-linked bonds, it is very important to make the distinction between longer-end linkers and short-term linkers. Indeed the mathematics of the bonds make longer-end linkers less effective as an inflation hedge, given the dominance of the duration returns over returns which might be generated by realized inflation. Short-end linkers clearly provide a superior inflation hedge, given their higher proportion of inflation returns relative to longer-end linkers. Ideally this should be combined with long break-even inflation strategies at the shorter end of the curve to further increase correlation to inflation.

- Convertible bonds come in a wide range of convexity, or interest-rate sensitivity, being priced like bonds at one end and trading like equities at the other. A portfolio can be constructed towards a blend of coupon returns in a stable market, but with equity exposure in the case of inflation. Our Defensive Convertibles strategy targets holdings with low interest rate sensitivity and low volatility. This focusses on convertible bonds where the equity price is currently low, but which offer noteworthy equity appreciation potential, reducing the sensitivity to inflation surprise.

- Outperforming Eonia in a booming equity market may seem modest, but it's quite a worthy goal when rates are feeling the pressure of inflation. Our Long Short Credit strategy is designed to invest in two types of opportunities. It invests in high-conviction positions, whether long or short, and in relative value positions (long/short opportunities) on a given issue or issuer. These performance engines are very complementary, and can be structured to maintain a zero net exposure to bond markets in a rising-rate environment.

Most prominent risks to investment strategies mentioned:

Short-Duration Inflation-Linked Bond strategies present mainly interest rate and credit risks, including in Emerging Market nations.

Convertible Bond strategies present mainly credit and interest rate risks, in particular because they are often smaller issuers. Some equity risk elements are also present.

Long Short Credit strategies present mainly credit risk and amplification from use of financial derivatives to create 'synthetic' positions.

This document is provided for information purposes only, it does not constitute an offer to buy or sell financial instruments, nor does it represent an investment recommendation or confirm any kind of transaction, except where expressly agreed. Although Candriam selects carefully the data and sources within this document, errors or omissions cannot be excluded a priori. Candriam cannot be held liable for any direct or indirect losses as a result of the use of this document. The intellectual property rights of Candriam must be respected at all times, contents of this document may not be reproduced without prior written approval.

Candriam consistently recommends investors to consult via our website www.candriam.com the key information document, prospectus, and all other relevant information prior to investing in one of our funds, including the net asset value (“NAV) of the funds. This information is available either in English or in local languages for each country where the fund’s marketing is approved.