As expected, the rise in long yields has speared a strong style rotation – see our article published in November 2021. Investor appetite for value stocks, coupled with significant profit-taking on growth stocks, has led to “value” companies outperforming their “growth” peers by almost 12% in January 2022So where are we now? And is “value” becoming “overvalued”?

With regard to long yields, we still believe that the US 10-year yields should reach the level of between 2% and 2.5%. As for the actions taken by the US Federal Reserve (Fed), the expected timeline is as follows:

- March 2022: the Fed’s asset purchases programme is expected to end.

- From March 2022: initial increases in key interest rates, with an expected potential rise of about 150 basis points (bps) just this year alone.

- From Summer 2022: the Fed will start reducing its balance sheet, by not renewing (or renewing very few) its maturing bonds.

For the German 10-year rate, we expect a maximum level of 0.50%. The European Central Bank (ECB) is also likely to shift away from its current dovish stance and face the issue of inflation. Indeed, the ECB has just announced a sharp reduction in its asset purchases, crescendo, by the end of the year. A first rate hike in the eurozone is thus likely at the start of 2023, or even the end of 2022.

Inflation on both sides of the Atlantic is likely to reach its peak in spring, which should bring markets some reassurance from this summer onwards.

To conclude on interest rates, it will be interesting to observe to what extent the large pension funds, which are “net” buyers of government bonds at the current level of yields (even more with yields above 2% in the US), will be able to compensate for central bank measures. Indeed, these investment giants, that have a strike force almost more powerful than that of the Fed, with their excessive exposure to equities, are now increasingly looking for “risk-free” returns.

In terms of economic growth, public deficits are likely to become a real problem. This may happen quicker than expected, if long yields continue to normalise and weigh on the cost of debt. Therefore, governments will be forced to exercise greater discipline. The market is expected to anticipate the Fed’s actions and their negative impact on the rate of economic growth, at least for 2023. Moreover, the improving pandemic situation, and a renewed investor confidence that it brings, might not be enough to counteract Fed’s impact.

As far as the markets are concerned, although we may continue to see a rise in US 10-year yields in the coming weeks, we believe that the value/growth adjustment is mostly behind us. Moreover, in an economic slowdown, we increasingly focus on companies which, due to the high potential area of their activity or their use of innovation, are able to grow their revenues and profits. We believe such companies will continue to offer the best value despite the challenging economic environment and generate intrinsic growth by offering solutions to numerous megatrends, such as energy transition, new health technologies, digitalisation and automation.

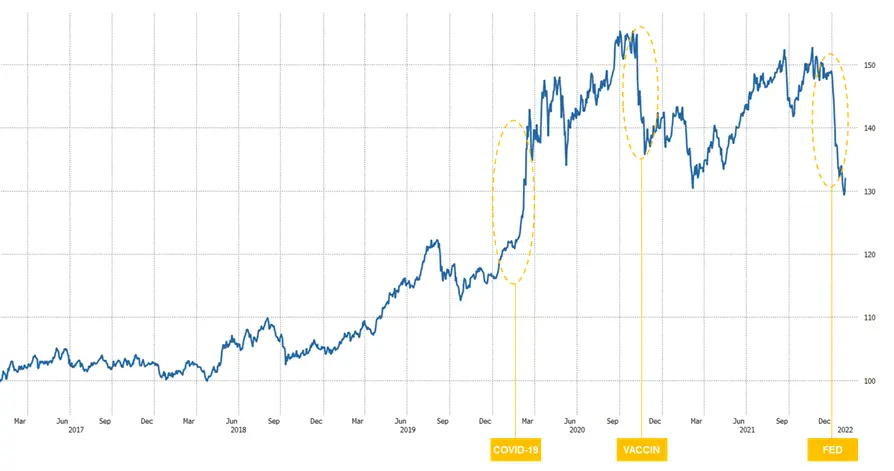

Relative performance MSCI EUROPE GROWTH NET RETURN/MSCI EUROPE VALUE NET RETURN, base 100, over 5 years. Source: Bloomberg, 31 January 2022.

Past performance of a given financial instrument or index or investment service, or simulations of past performance, or future performance forecasts are not reliable indicators of future performance.

Although the value vs growth analysis will remain very important in understanding the investment environment over the coming weeks, we believe that investors need to look further ahead. In our view, a factor for investing, which will quickly become key in 2022, will be investor preference for defensive vs cyclical stocks, rather than the value vs growth debate. Watch this space!